Home insurance is an important aspect in safeguarding your house and the possessions it contains. It acts as a safety net in times of hardship. Having a rough idea of how much a Approximate Home Insurance Cost is also important when planning a budget.

What Influences Home Insurance Costs

The distance from the target market is most often used as a benchmark when arranging for a home insurance estimate. Other factors that need to be considered are the location of the property as well as the value of the property to be covered and the type of coverage required.

Typically areas that are marked as high risk tend to pay higher annual premiums than that of low-risk areas. A house insurance calculator assists in this regard. It gives rough estimates which help in better projections. You can also learn more on the subject at Home Owners Insurance in FL for more resources and accurate information.

Importance of Using a Homeowners Insurance Calculator

🔍 Rapid and Reliable Cost Projections

Homeowners insurance calculator offers quick and accurate estimates of costs. Go to the ‘height’ section, for example for the property, and it works out premium rate risks that are likely to be incurred. This is efficient, saves time, and makes budgeting easier.

📈 Hefty costs can be avoided

There are also plenty of times when a homeowners insurance calculator is good to use as it can help in making this overpayment for coverage unnecessary. It analyzes prices and outputs that are simply not needed. You only are charged for the services that you have actually subscribed.

Many offers confuse their customers by the presence of add-on options when not needed. Cheap Auto Insurance in Florida emphasizes importance to cost effectiveness. It streamlines coverage allowing drivers to get just what they want and need for their money.

🏡 Designed For Your House

These calculators prepare users to input variables, including how big the home to be insured is, where it is located, how much coverage is needed, etc. All clients are thus assured of receiving correct and relevant estimates that apply to them.

🚨 Highlights Cost Components

Homeowners insurance calculator discusses several determinants of premiums. This includes age of property, as material of construction and safety features. There is a need for all homeowners to assess their insurance options deeply. Such a choice guarantees protection in times of great uncertainty.

Best And Worst Homeowners Insurance Companies assists in providing the consumer with such knowledge. This also assists in such areas control for cost awareness.

📊 Allows Easy Evaluation

With the help of several calculators on the same webpage, the estimation of other providers, as well becomes easy. It ensures that the best coverage is obtained at the lowest possible price.

🎁 Assists In Future Decisions

Such problems of forecasting also assist in long term planning. Within the boundaries of no hurt, you will naturally perform effective fund allocation. Therefore there is great scope in using a mortgage insurance premium calculator. For more details check How Much Is Homeowners Insurance.

How to Use a Household Insurance Calculator

It is easy to estimate costs as you are able to use a household insurance calculator. One such example is the size, age and location of the home. Submitted data helps the home insurance calculators in estimating premiums which ensures quick answers. This tool is efficient and saves time.

It is easy to estimate costs as you are able to use a household insurance calculator. One such example is the size, age and location of the home. Submitted data helps the home insurance calculators in estimating premiums which ensures quick answers. This tool is efficient and saves time.

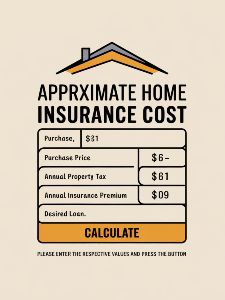

Homeowners Insurance Calculator

Benefits of Comparing Home Insurance Quotes Calculators

Leverage the power of a home insurance quotes calculator to ensure your rates remain competitive. Assures assistance in selecting rate that falls within the desired price range. When seeking estimates, always do a comparison of several of them for cost savings.

Why You Need a Home and Contents Insurance Calculator

A home and contents insurance calculator provides an estimate of the belongings to aid assess humility that you seek to insure. Everything from the household items, electronics and other valuables would fit into this role. This type of protection is meant to guard against loss or damage caused from theft.

How to Estimate Costs With a Home Insurance Premium Calculator

A home insurance premium calculator simplifies the entire process in detail. Property types and the amount of coverage needed can be keyed in. The calculator gives information on premium rates which makes it unnecessary for hidden costs to exist in the transaction.

Pros and Cons of Home Insurance

PROS | CONS |

Financial security | Premiums can be expensive |

Protects against unexpected loss | Deductibles may apply |

Covers natural disasters | Not all damages are covered |

Includes personal belongings | Complex policy terms |

Using a House Insurance Cost Calculator for Budgeting

By using this first component, the house insurance cost calculator, one can ensure adequate and effective budgeting. If one knows or estimates the approximate price then it is much more difficult to go above the budget. Consider employing such resources like the home insurance rate calculator while estimating the expenses.

How to Obtain A Quote for Mortgage Insurance

- Collect the details of the property including its value and the total area of the property.

- Enter these values into the mortgage insurance quote tool.

- Examine the estimated premium value and change the limit on the coverage accordingly.

The Importance of a Home Contents Insurance Calculator

No one insures their personal effects such as clothes, furniture, food. This is what a home contents insurance estimator does. How much should you expect to receive for your property in case it gets lost, destroyed, or stolen? You will find the accurate answer in the home possessions insurance calculator.

The Need for Accurate Valuations of Home Contents Insurance Policies

Having accurate estimates will make sure that you do not run at a loss. Tools for home insurance quote should be employed in this case. Always provide the essential information, and in turn, expect the most accurate results from the home owners insurance quote calculator.

How a Home Insurance Cost Calculator Works

Homeowners can now use home insurance cost calculator which is very easy to use. This is useful for determining premiums based on the area of the house, its location and even the type of insurance to obtain. It’s as simple as filling out a form and getting an estimate.

Advantages of Online Calculators

- They help you to get the result very quickly.

- Whether they’re local or not, they’re helpful in making comparisons and finding better ways to save money.

- There is the option to modify the variables for more exact calculations.

Tips for Using a House Insurance Premium Calculator

🏡 Know What Your Home Is Worth

Since you’ll be using a house insurance premium calculator, it is clear that you must value your home. On top of the market value, this will require valuing the cost of reconstruction as well. The calculator will require details such as area in square feet, building materials and other unique aspects. Make sure all the information provided is correct because in any case of an error the amount of insurance coverage will be inadequate to cover losses.

💰 Project Your Finances.

Using insurance calculators online is usually advised as they offer a reasonable estimate of the insurance premiums cost required for a certain amount of coverage. Before you go uses the tool, you should set your maximum allowance. Figure out the maximum amount you are willing to spend on monthly premiums and use the calculator to vary the parameters of coverage to an amount you are comfortable paying.

🔍 Provide the Necessary Details.

You can place yourself in an approximate range of how much the payment will be, if you use only the approximate figures, narrowing down the scope of coverage further on. To illustrate, mention the age of the house, plane type and area in which it’s built. They are among the most important features when determining a premium. The calculator will factor in risks relevant to your region such as flooding and windstorm incidences to provide a more accurate estimate range.

🌍 Consider Other Coverage Needs as Well

As well as routine home coverage, there are extras that can be taken out. For instance, when the customer possesses some high-value items such as jewelries or electronic devices, the calculator will accommodate the coverage for such items. Also, remember to include protection for liability in case of all accidents.

🔄 Review and Compare Different Scenarios

Jason’s online calculator can be beneficial in the given context. For example try raising the deductible or lowering coverage limits. This also provides important information of these trade offs for the cost and coverage which assist in making a decision.

💡 Use the Calculator Regularly

The value of a house and individual situations are not static and these can influence insurance requirements over time. This means revisiting the calculator from time to time, especially after home improvement works have been conducted or expensive items have been made procured. There seems to be every reason because adjustments to your policy cover would mean that you are protected and at the same time, would not have to pay unnecessary amounts.

📈 Understand the Factors That Impact Premiums

There are numerous drivers of your premiums, and learning these factors makes it easier to make wise decisions. To start with, the geography is clearly the most important factor making one’s residence in a flood or natural disaster zone likely to have high premiums. But a security system or home fire alarms can bring down your premiums. Adjustment should therefore be made on the calculator to account for these savings.

🧑🤝🧑 Consult with Insurance Experts

And, there seem to be one tool that many people use, which is the calculator that is very powerful. Conversely, one should not hesitate to see an expert who is in charge of an insurance company. With expert advice, a client’s coverage needs can be more focused than before. It is possible that an agent can add information on exclusion and special additions to the policy that one can not see on the calculator

How to Use a Homeowners Insurance Premium Calculator Effectively

Maximize accuracy by:

- Updating property details regularly.

- Considering all coverage types.

- Comparing multiple tools for the best results.

Common Misconceptions About Home Insurance

Do not be deceived that home insurance policy covers all insurance questions and concerns. There are those who think that they include coverage for flooding or earthquakes within such policies. Policy documents must be read properly and understood to avoid confusion.

Another fallacy is that higher value of the policy is best in terms of coverage of loss. Even research into the property insurance market using a home insurance price calculator, for example, can uncover less expensive options.

Instances of Home Insurance Savings in Society

Prior to getting insured, John put a lot of thought into whether he would use a home insurance cost calculator. He switched providers to find a suitable quote for himself. This saved him $300 per year. Homeowners insurance premium calculator is believed to enable options with lower rates and reasonable insurance limits.

Sarah also fell in line when she had her valuables covered through a home and contents insurance calculator. She eventually settled with a policy that insured her against fire, theft and other damages. Therefore this was to give her protection in case such an eventuality would occur.

FAQs on Home Insurance Costs

Use a home insurance cost calculator for better estimates.

Yes. You may save money by installing security features or by comparing quotes.

It is an estimated figure for how much it would cost to protect the property and all the possessions inside it.

Yes. Tools like the home insurance price calculator will provide you correct answers without any doubts.

You can use any homeowners insurance cost estimator to be able to do this.

Not always. Sometimes you have to pay extra to get other hazards covered.

Final Thoughts

Are you looking for advanced planning of your finances? If yes then it is wise to understand the house insurance estimate before making the plans. This can be done using tools like the home insurance premium calculator and home insurance cost calculator to get quite close to the actual figures. However when doing that then always check the coverage options using house insurance calculators comfortably.

It does not help to constantly worry about your home as complete insurance safeguards you against all sorts of catastrophes. Use estimates to find the best plan and try to be patient when doing so.

Most commented